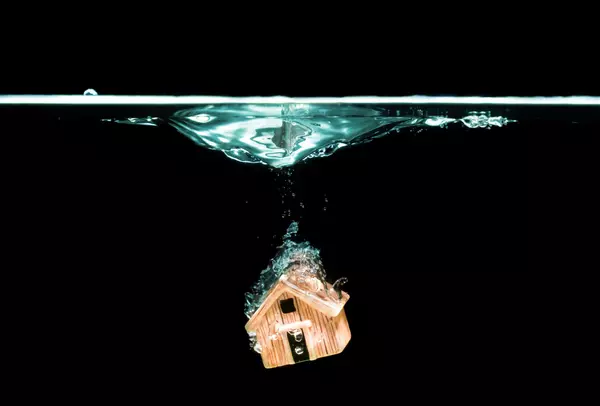

2023 Housing Market DEEP DIVE: Challenges and Strategies for Prospective Homebuyers

The year 2023 has presented unique challenges for those navigating the housing market. Rising mortgage rates, exorbitant home prices, limited inventory, and an intricate buying process mark the landscape. This article aims to provide an in-depth exploration of these challenges and potential strategies for overcoming them.

The Unforeseen Ascent of Mortgage Rates

One of the most significant hurdles for prospective homebuyers in 2023 has been the steep rise in mortgage rates. Data from Freddie Mac reveals that as of October 2023, the average 30-year fixed mortgage rate reached a seven-year high1. This increase has profoundly impacted the affordability of homes and the ability of many prospective buyers to secure a mortgage.

High mortgage rates not only mean higher monthly payments but also affect the amount of loan a buyer can qualify for. Consequently, buyers may find themselves priced out of markets they could previously afford, or having to adjust their expectations and opt for smaller homes or homes in less desirable locations.

To navigate this challenge, it's crucial for buyers to keep a close eye on trends in mortgage rates and understand how these rates affect their borrowing power. Engaging the services of a reputable mortgage broker can provide valuable insights and advice. Buyers should also explore various loan types and options, such as adjustable-rate mortgages, which may offer lower initial rates.

The Staggering Increase in Home Prices

The second major challenge lies in the dramatic escalation in home prices. According to the National Association of Realtors, the median existing home price for all housing types in September 2023 was $354,9002, reflecting a nearly 14% increase from September 2022. This surge is largely driven by supply and demand dynamics. The demand for homes, fueled by low inventory and increased savings during the pandemic, has outpaced supply, leading to price increases.

The rising home prices have exacerbated the affordability crisis, making homeownership an elusive dream for many. Prospective buyers, particularly first-time buyers and those with lower incomes may find it increasingly difficult to save for a down payment.

To combat this, buyers might consider exploring various down payment assistance programs or looking into less conventional housing options such as co-housing or purchasing a fixer-upper. Location flexibility can also open up more affordable markets.

The Death of Available Homes

The third significant hurdle is the limited inventory of available homes. Zillow's data indicates a 13.4% year-on-year drop in inventory levels as of September 20233. The scarcity of homes for sale has led to increased competition among buyers, often resulting in bidding wars that drive prices even higher.

To stand out in this competitive market, buyers need to be strategic. This could mean getting pre-approved for a mortgage to demonstrate serious intent, being ready to act quickly when a suitable property comes on the market, or writing a personal letter to the seller to help your offer stand out.

The Intricacies of the Home Buying Process

The complexities of the home-buying process present another challenge. This process involves multiple steps, each with its terms and requirements. From understanding the importance of a good credit score to navigating the process of home inspections and appraisals, the learning curve can be steep for first-time buyers.

Education is key to overcoming this hurdle. Buyers should take time to familiarize themselves with the process, attend first-time homebuyer seminars, or enlist the help of a real estate agent. Having a team of professionals, including a real estate agent, mortgage broker, and attorney, can provide valuable guidance and support.

The Overall Difficulty of the Buying Experience

Finally, the culmination of these challenges led to a difficult buying experience. A National Association of Home Builders survey found that 76% of Americans view housing affordability as a crisis4.

Despite these challenges, prospective homebuyers should not lose hope. With careful planning, strategic decision-making, and a team of knowledgeable professionals, navigating the 2023 housing market is possible. It's important to remember that while the current landscape may be challenging, it also offers opportunities for those who are prepared and informed.

Sources:

Categories

Recent Posts